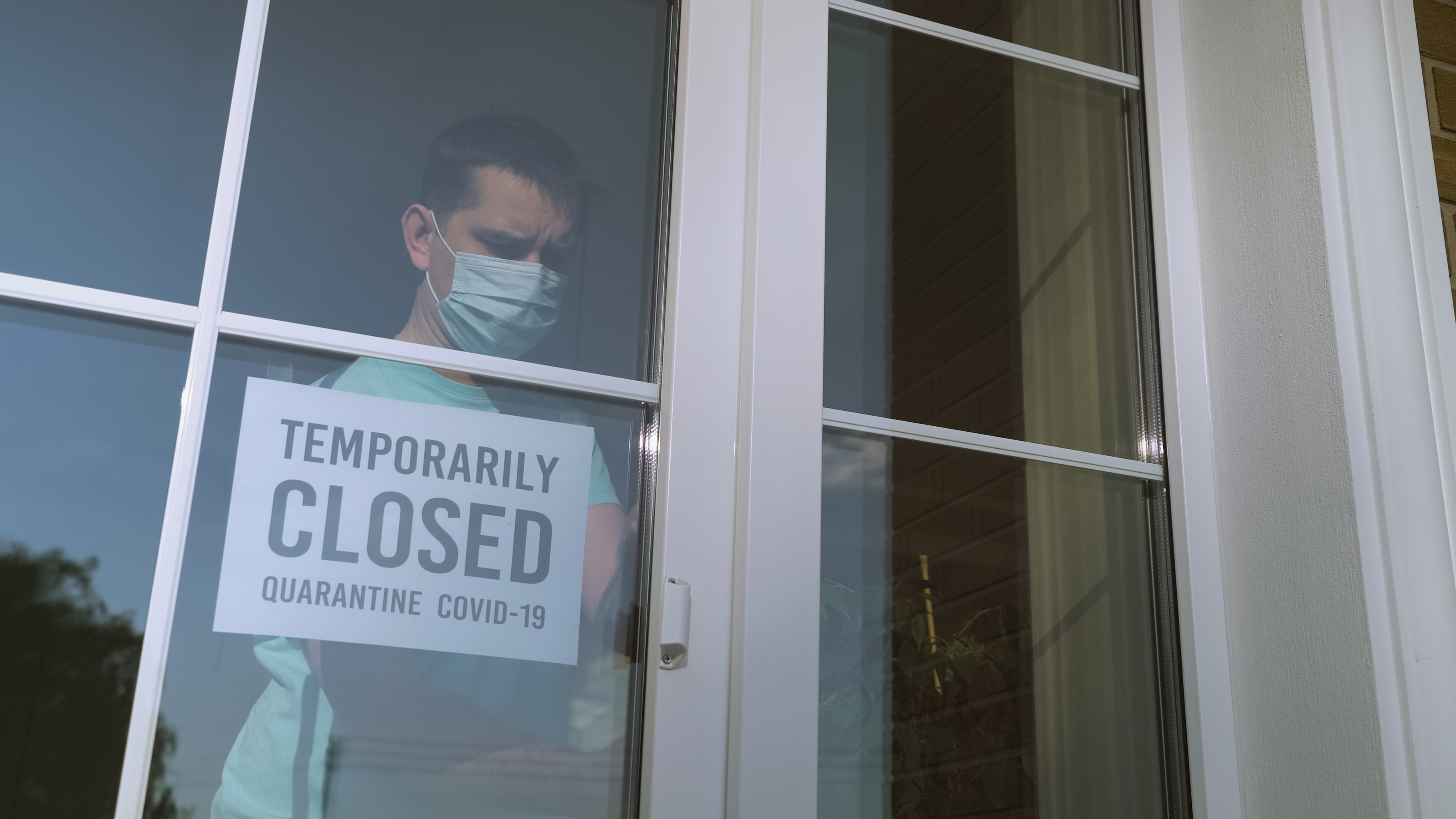

An insurer has won the first jury trial on coverage for Covid-19 business interruption losses after a federal jury in the Western District of Missouri issued a verdict in favor of The Cincinnati Insurance Company in K.C. Hopps Ltd. v. Cincinnati Insurance Co., Case No. 4:20-cv-437 (W.D. Mo. 2021). In K.C. Hopps, the insured, K.C. Hopps Ltd. (“Hopps”), owned and operated bars, restaurants, catering services, and event spaces in the Kansas City metropolitan area. In response to the Covid-19 pandemic, civil authorities in Missouri and Kansas issued stay-at-home orders in March of 2020. In accordance with the orders, Hopps’ operations were limited to delivery, drive-through, and carry-out services. Hopps submitted a claim to its insurer, Cincinnati Insurance Company, for coverage…